Quest Holdings (ATHEX: QUEST) announces 6M 2018 financial results in accordance with the International Financial Reporting Standards.

During the first half of 2018 Quest Group achieved the following:

- Double digit growth in Sales (+20%) compared to last year’s first semester.

- Double digit growth in EBITDA (+29%), in EBT (45%) and in Earnings per Share (57%) compared to last year’s first semester.

- Improvement in liquidity by €25m, reaching a net cash position of €20,5m compared to -€4,5m in the end of 2017.

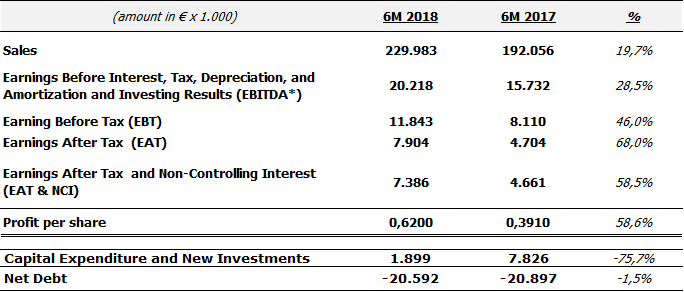

Major consolidated financial results & figures are illustrated as follows:

* EBITDA do not include “other gain/losses” related to investment activity.

The Group’s investments during 2018 first half were € 1,9m (76% down from 2017), almost evenly distributed to all segments.

Parent Company “Quest Holdings”

Parent company “Quest Holdings” Revenues during 6M 2018 reached €4,04m compared to €2,82m during the same period last year. EBT were €3,24m compared to €2,43m last year and EAT were €3,24m compared to €2,35m during 6M 2017. Quest’s Holdings revenues during 6M 2018 include €3,43m in dividends compared to €2,26m during last year’s 6M. 6M 2018 revenues include €3,43m dividend amounts vs €2,26m in 6M 2017.

Review of 1st Half per segment & Outlook for the whole 2018.

Regarding the first half of 2018 and the outlook of the rest of the current year, we note the following per business segment:

- IT Products (Info Quest Technologies, Quest on Line (you.gr), iSquare, iStorm)

- There was a double digit sales growth (+33%), which is however not depicted in EBT growth (-95%) due to extraordinary provisions of €1,4m that had to be taken to cover a possible retroactive payment of intellectual property rights, applied at the end of May 2108, by legal act 4540/2018. Quest’s Group’s management has strong reservations about the legal correctness and the constitutionality of the respective payment enforcement. The organic result of the segment (before the above extraordinary provision) is equally higher. All companies grew faster than their sector’s average growth rate and gained market share.

- Growth is also estimated for the rest of 2018, most probably at a more moderate rate. Improvement in profitability vs first half is also foreseen.

- IT Services (Unisystems Group)

- In the first half of 2018 sales remained at the same levels as last year, whereas EBT is lower (-65%). EBT were adversely affected by budget excesses in two large projects.

- For the remaining 2018 we expect similar results due to difficulties in the local market and the above mentioned projects.

- Postal Services (ACS Courier)

- There was a nearly +4% sales growth during 6M 2018, mainly fueled by courier services for e-commerce, while EBT grew by +13,5%.

- Growth in sales is estimated for the remaining 2018. Growth in profitability will most probably be more moderate. The start of the new growth investments, regarding the new sorting hub in Athens, is also estimated to occur till the end of the year.

- Electronic Payments (Cardlink)

- A high growth in sales (+43%) and even higher in ΕΒΤ (x5) was achieved during 6M of 2018 compared to 6M of 2017. The growth was fueled mainly by the legislative enforcement of POS installations in merchants and the returns of previous year investments.

- Growth is estimated for the rest of 2018, most probably at a more moderate pace.

- Renewable Energy Production (Quest Energy Group)

- All results are significantly higher in 6M 2018 due to the acquisition of two new solar parks during 2017. The total installed base by now, has reached 5,7ΜW compared to 0,7MW during 6M 2017.

- Growth in sales and profitability is estimated to continue during the remaining year, while additional growth investments are further planned.

Quest Group continues to implement its business plan aiming at sales growth, operational costs containment, risk and credit mitigation, controlled debt exposure and the steady production of positive operational cash flows.

The results of the first half are validating our initial estimations regarding the growth of the Group’s aggregate results and positive operational cash flows. Assuming a steady Greek economy macro environment, it is estimated that Quest Group will demonstrate increase of its main financial figures as well as positive operational cash flows during remaining 2018 most probably at a more moderate pace than 6M 2018.

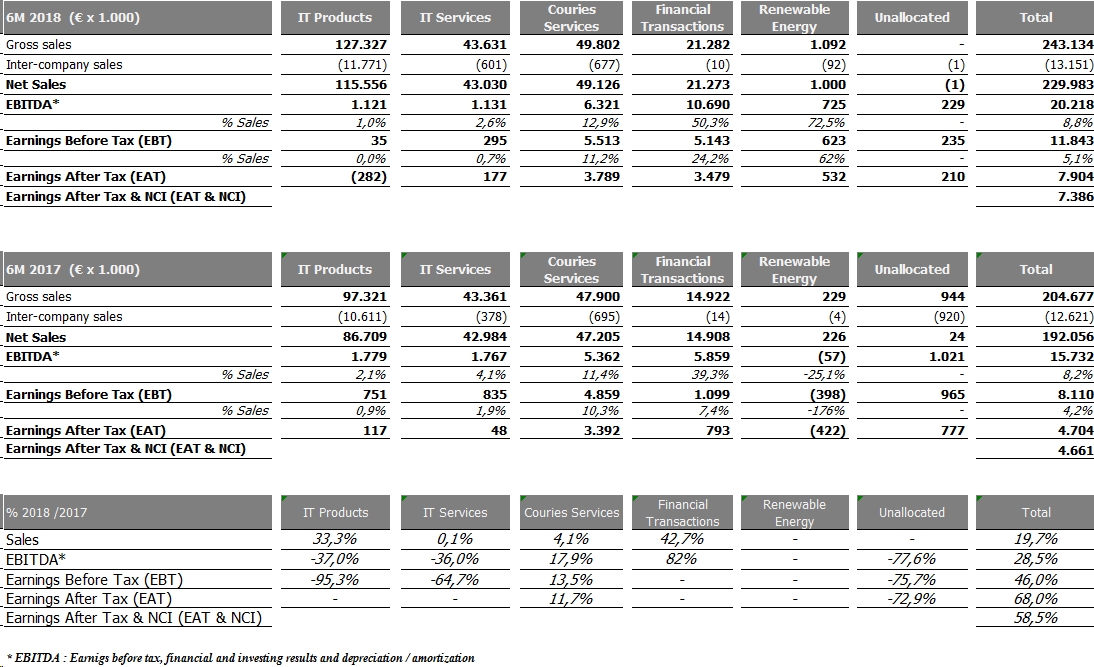

The following tables present the results per segment:

Quest Group 1st Half 2018 Financial Results per Operating Sector:

Parent Company is included in Unallocated activities.

6M 2018 Financial Statements of Quest Holdings will be posted on Athens Stock Exchange website (www.helex.gr) and on Quest Holdings corporate website (www.Quest.gr) on Tuesday 11th of September 2018.

Note: This document is a translation of the corresponding official document which has been submitted to the Athens Stock Exchange in Greek. The Greek version of this document will apply and prevail in all cases.