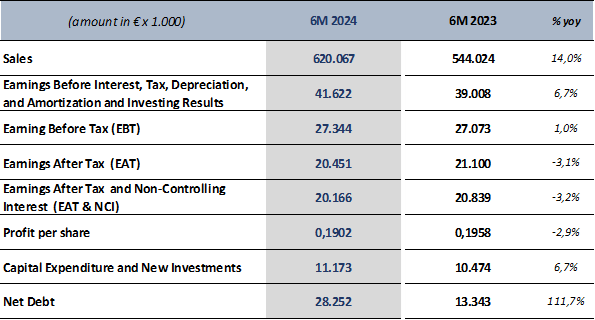

During 6M 2024 Quest Group recorded Sales €620m, EBITDA €41,6m, EBT €27,3m and EΑΤ €20,5m.

Compared to last year’s 6M, Quest Group Sales grew by 14%, EBITDA by 6,7% and EBT by 1%, while EAT decreased by -3,1% respectively. Low EBT increase rate is driven by squeezed Gross Margins in Commercial Activities and by higher financing costs due to high Euribor and higher debt.

During Q2, all main figures augmented significantly on a YoY basis, namely Sales by 22,8%, EBITDA by 17,6% and EBT by 16,7%.

The main consolidated financial results & figures are illustrated as follows:

* Do not include “other gain/losses” related to investment activity.

Group’s Net Debt (Debt - Cash and Cash Equivalents) was €28,2m, compared to €17m at 31/12/2023. The change is mainly due to Working Capital needs.

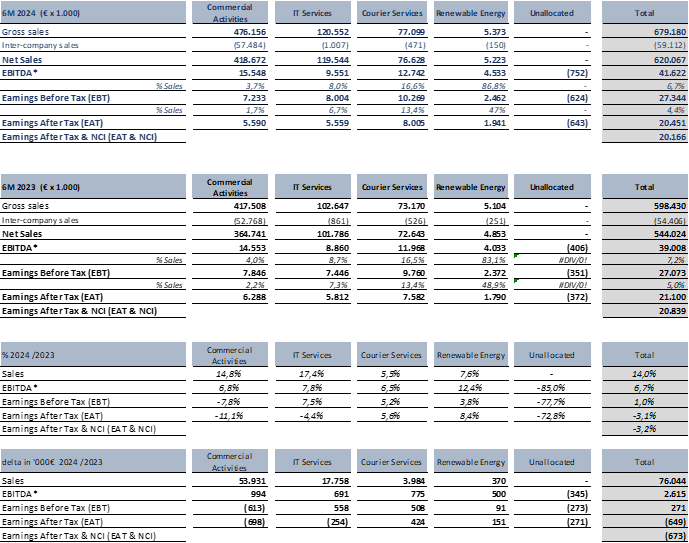

6M 2024 Results per segment:

- Commercial Activities (Info Quest Technologies, Quest on Line, iSquare, iStorm, Clima Quest,GED, FoQus).

Sales grew by a double digit (+14,8%), followed by an EBT decrease by -7,8% on a YoY basis. Lower profitability is mainly driven by squeezed Gross Margins in the Apple Ecosystem, lower contribution of Clima sales after the termination of last year’s subsidies program, and by high financing costs due to high Euribor and debt required for the expansion in the Romanian market.

- IT Services (Uni Systems, Intelli Solutions, Team Candi).

Sales augmented at a double-digit pace (+17,4%), and EBT by +7,5%. Demand for IT services continues to be strong, due to the high number of digital transformation projects of the private and public sector. Roughly 50% of sales are related to international activities.

- Postal Services (ACS Courier).

Sales increased by +5,5%, followed by an EBT increase of +5,2%. Growth is mainly driven by the rate of expansion of e-commerce which was lower than expected during 6M 2024.

- Renewable Energy Production (Quest Energy).

Sales were mildly higher by +7,6% , while EBT increased by +3,8% due to higher depreciations and financial costs.

Quest Holdings (parent company).

Parent company revenues during 6M reached €15,8m compared to €11,6m during the first half, out of which €15M are dividends coming from its subsidiaries. EBT were €14,3m compared to €10,4m during the same period last year.

2024 Outlook

The following outlook is estimated per segment:

Commercial Activities: We estimate a mild growth in sales compared to 2023. EBT is expected to improve in H2 compared to H1 and to land at the same levels or slightly lower than 2023. Main drivers are primarily squeezed Gross Margins and the significant increase of financial expenses (caused by Euribor’s rise) and secondarily higher depreciations.

IT Services: Growth both in sales and profitability is estimated vs 2023, driven by a high demand for IT services in Greece and international markets. The company’s backlog (contracted projects to be executed) exceeds €550m.

Postal Services: H1 growth pace is estimated to continue through H2, at similar or higher to e-commerce expansion rates.

Renewable Energy Production: We estimate growth in sales and profitability driven by new investments, based on the hypothesis of normal weather conditions.

On aggregate for 2024, we estimate mild growth in Sales, EBITDA and EBT. It must also be noted that the Group has a solid commercial and financial position to successfully address any challenges that might arise, having more than €300m in cash and available credit lines.

Quest Group’s management will host a conference call to present and discuss the 6M 2023 Financial Results, on Thursday 5th of September 2024, at 15:30 Athens time.

- GR participants dial in: + 30 213 009 6000 or + 30 210 946 0800

- UK participants dial in: + 44 203 059 5872

- US Participants dial in: +1 516 447 5632

The conference call will be available via webcast in real time over the Internet and you may join by linking at the internet site: Webcast Link

Group’s 6M 2024 Financial Results per Operating Sector:

Parent company is included in Unallocated functions.

6M 2024 Financial Statements of Quest Holdings will be posted on Athens Stock Exchange website (www.helex.gr) and on Quest corporate website (www.Quest.gr) on Thursday 5th of September 2024.