During 2021 Quest Group recorded Sales €947,9m, EBITDA €75,6m and EBT €136,1m. Excluding Cardlink’s numbers which was sold on the 30/9/2021, consolidated sales from continued operations were €915,9m, EBITDA €64m and EBT €51,3m.

In a nutshell during 2021 the Group:

- Completed the sale process of Cardlink S.A. The transaction yielded extraordinary capital gains of €78,1 m.

- Achieved growth in Sales by 33,3%, in EBITDA by 33,7%, in EBT by 59,6% and 3x growth in EAT from continued operations. Three segments contributed more than €10m each.

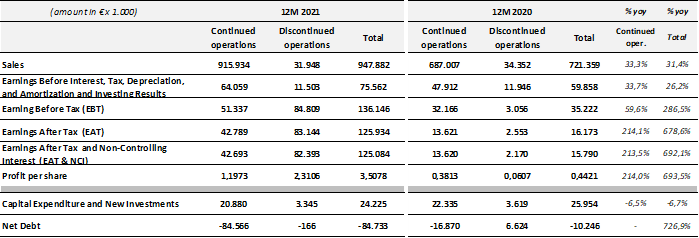

The main consolidated financial results & figures are illustrated as follows and are broken down to continued and “discontinued” operations (corresponding to Cardlink S.A. and Cardlink One S.A. and the sale of Cardlink S.A., according to IFRS):

* Do not include “other gain/losses” related to investment activity.

Group’s Net Debt (Debt minus Cash and Cash Equivalents) was -€84,6m, compared to -€10,2m at 31/12/2020, enhanced by the proceeds from the sale of Cardlink. The Group’s investments were €24,2m. Most of it regards to the development of the new central hub of postal services. EBT and EAT from continued operations include extraordinary profits of €2m mainly from the sale of a minority stake at TEKA Systems SA. At this point it worth noting that 12M2020 EAT from continued operations were burdened by an extraordinary tax of €11,1m. Exempting the extraordinary tax impact, EAT from continued operations in 12M2021 are improved by 73% compared to last year.

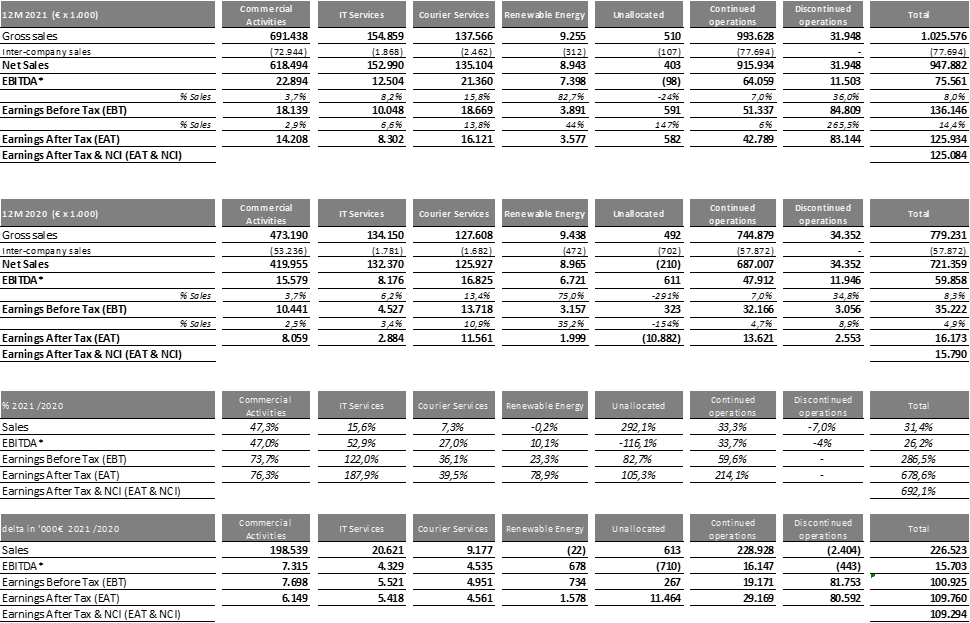

12Μ 2021 Results per segment:

- Commercial Activities (Info Quest Technologies, Quest on Line, iSquare, iStorm, Clima Quest, FoQus).

Sales grew by double digit (+47,3%), followed by a doubled EBT growth (+73,7%) on a YoY basis, since the pandemic accelerated the demand for IT products and e-commerce. The improvement in profitability margins is driven by economies of scale due to the steep increase in sales and cost containment.

- IT Services (Uni Systems, Intelli Solutions, Team Candi).

Sales augmented at a double-digit pace (+15,6%) while EBT more than doubled (+122%) with significant improvement in profit margins. Demand for IT services continues to grow, partly because of digital transformation projects of the private and public sectors which accelerated. Furthermore, Uni Systems managed to operate more efficiently and contained its financial and other costs.

On the 1st of October 2021, Uni Systems acquired 60% of Intelli Solutions for an amount of €3,8m. The investment amount may climb up to €5,2m if an earnout projection to previous shareholder is triggered, based on the achievement of specific milestones within the 2021-2022 period.

- Postal Services (ACS Courier).

During 2021 sales improved (+7,3%), followed by an even higher increase in EBT (+36%). ACS profitability is elevated on an YoY basis, due to extraordinary profits generated by the reversal of past years’ provisions. These extraordinary profits amplified EBT by about €3m. Recurring profitability also increased at a slower pace. Once physical retail opened, ACS growth decelerated following the relative e-commerce trends.

- Electronic Payments (Cardlink).- Discontinued activity

After the agreement with Worldline and based on IFRS the activity is considered discontinued and its consolidation

ceased as of 1st of October 2021 and onwards. 9M 2021 results were: Sales of €31,9m and EBΤ €6,7m.

- Renewable Energy Production (Quest Energy).

During 12M 2021 sales were similar to last year. EBT however was significantly higher by (+23,3%) due to the lack of an extraordinary tax which was imposed during 2020.

Quest Holdings (parent company).

Parent company 2021 Sales reached €13,2m compared to €15m last year. EBT reached €150,4m compared to €13,1m in 2020. QH’s 2021 income includes dividends of €11,4m compared to €13,3m last year. QH EAT were positively affected by €85,2m from the sale of Cardlink and by €2m from the divestment from minority stakes at TEKA Systems S.A. and Impact S.A.

Furthermore, subsidiaries’ valuations based on the DCF method (Discounted Cash Flow), resulted to significantly higher valuations for “Infoquest Technologies” and “Uni Systems” compared to their Net Values, as they were depicted in the company’s books. These values occurred due to impairments taken during the past years. The re-evaluation of these participations led to significant earnings before taxes for the parent company of €52,4m. The result does not impact the Group’s EBT given that the consolidated financial reports depicts the Net Value of subsidiaries and not the cost of their acquisition.

2022 Outlook – Estimations for the continuing operations

In more detail, the following outlook is estimated per segment:

Commercial Activities: The initial estimations forecast increased sales driven by increase of market share, launch of new product categories and e-commerce growth mainly form April on. However, there are serious concerns about the consumption trends and the economy in general, given the impact of the energy cost and the war in Ukraine.

IT Services: For 2022 initial estimations foresee further growth in sales, driven by high demand for services in Greece and abroad. Intelli Solutions is expected to further assist the segment’s growth, having an EBITDA contribution of more than €1m.

Postal Services: The initial estimations for 2022, foresee a mild growth in sales driven by e-commerce growth especially after the first 4M. However, there are serious concerns about the consumption trends and the economy in general, given the impact of the energy cost and the war in Ukraine.

Renewable Energy Production: The company increased its installed base in 2022 reaching 30MW. Further growth is planned for 2022 targeting a total output power of more than 32MW.

The Group’s cash position is solid, having above €200m in cash and available credit lines, allowing the non-disruptive continuation of its planned investments.

Furthermore, the Group distributed an interim dividend to its shareholders of total €45m (€1,25/ share).

In total, initial estimations for 2022 forecasted growth in both sales and profitability from continued operations (excluding capital gains), which is validated during the first 2M. However, given the instability in the global economy, the war in Ukraine, the inflation in energy prices and goods and the impact in consumption trends, the Group reserves from making a precise forecast for 2022, for the time being. It must be noted that the Group has a solid commercial and financial position to successfully address any further challenges that might arise.

Quest Group’s management will host a conference call to present and discuss 2021 Financial Results, on Thursday 7th of April 2022, at 15:30 Athens time.

- GR participants dial in: + 30 213 009 6000

- UK participants dial in: + 44 203 059 5872

- US Participants dial in: +1 516 447 5632

Group’s 2021 Financial Results per Operating Sector:

Parent company is included in Unallocated functions.

2021 Financial Statements of Quest Holdings will be posted on Athens Stock Exchange website (www.helex.gr) and on Quest corporate website (www.Quest.gr) on Thursday 7th of April 2022.